Thetanuts protocol is a decentralized on-chain option platform for altcoins, with the ability to trade both long and short on-chain options.

Since its initial launch in September 2021, Thetanuts Finance has evolved from its Basic Vault model to its current more comprehensive v3 architecture, designed to address the specific needs of the altcoin market.

If you need an altcoin option trading platform, check out this guide to Thetanuts.

What Is Thetanuts Finance?

Thetanuts Finance offers a deep DeFi platform that offers a growing range of opportunities for users to participate in decentralized options trading. Operating across an increasing number of blockchain networks, it provides an ecosystem for both experienced and novice altcoin option traders.

Currently, Thetanuts Finance supports a robust selection of prominent blockchain networks, including:

- Ethereum

- BNB Chain

- Polygon

- Avalanche

- Cronos

- Arbitrum

- Filecoin

- Polygon ZkEVM

Multi-chain compatibility is a key feature, allowing users to engage with the platform regardless of their preferred blockchain environment.

Liquid Markets Create More Opportunities

Providing liquidity is crucial for the smooth functioning of any DeFi platform, and Thetanuts Finance offers several incentives to encourage participation in this area.

Users on Thetanuts Finance v3 have access to up to five potential yield sources designed to maximize their returns.

The first source is option premiums generated from Basic Vaults. These vaults allow users to earn yield by providing liquidity for options trading.

The second source of yield comes from lending interest earned through the Lending Market. This feature empowers liquidity providers to lend their assets and earn interest on their holdings.

The third income stream comes from trading fees generated by the Automated Market Maker (AMM).

As users trade options and other assets on the platform, liquidity providers earn a portion of the costs generated by these transactions (this is the fourth way to earn). Furthermore, users may also be eligible for $NUTS token incentives in the future, offering an additional layer of potential rewards.

How Do Options Trade On Thetanuts?

Thetanuts Finance v3 employs a cash-settled approach for its options contracts. This means that when an option is exercised, the settlement involves the delivery of the net cash amount on the settlement date, rather than the physical delivery of the underlying asset.

Furthermore, options on Thetanuts Finance v3 are European-style, meaning options can only be exercised at the expiration date, i.e., at a single pre-defined point in time. This contrasts with American-style options, which can be exercised at any time before the expiration date.

At expiration, the Basic Vault option contracts will be exercised if they are in-the-money (“ITM”), meaning that the option’s strike price is favorable compared to the current market price of the underlying asset.

The v3 Upgrade

The Thetanuts v3 upgrade represents a significant shift for the Thetanuts Finance system. Today it’s a decentralized on-chain options protocol with a dedicated emphasis on altcoins.

This new architecture takes advantage of the existing Basic Vault LP Tokens to unlock new functionalities within on-chain options trading.

These functionalities are facilitated by a Lending Market and Uniswap v3 Pools, all accessible through the v3 interface, aiming to provide a more streamlined and user-friendly experience.

The v3 upgrade offers several key benefits:

Basic Vaults at the Core

Basic Vaults will remain a fundamental component of Thetanuts Finance v3. The Basic Vault LP tokens serve as the foundation for the v3 ecosystem, allowing Thetanuts Finance to capitalize on its prior expertise as a leading Option Vault protocol focused on altcoins.

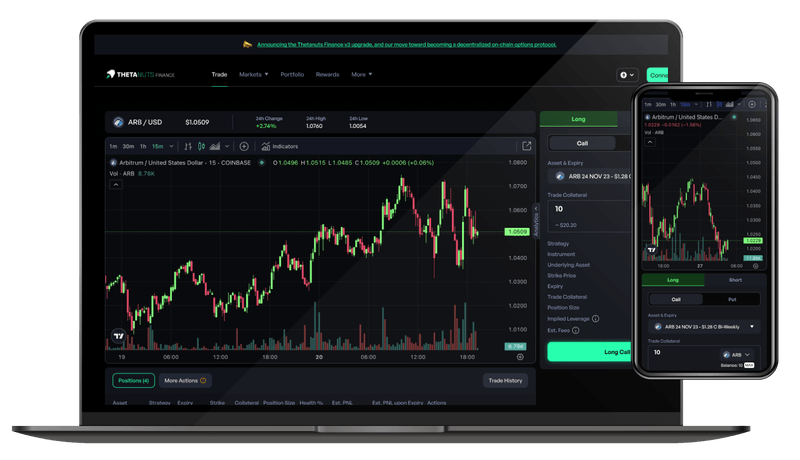

Unified Interface

The v3 interface provides a trading-like experience, simplifying the process for traders by integrating Basic Vaults, the AMM, and the Lending/Borrowing Market into a single platform. This abstraction eliminates the need for users to interact with each component separately.

Ability to Buy Options

Option Vault strategies are primarily sell-side oriented, lacking the ability for users to take long positions. The v3 upgrade addresses this limitation by enabling users to buy options through the AMM and Lending Market.

Flexibility to Exit Basic Vault LP Positions

Before v3, Vault LPs were required to wait until the end of the next epoch to exit their positions, potentially delaying their exit by up to a week. With the introduction of the AMM, users can now instantly swap out of Basic Vault LP tokens, allowing them to close their positions without waiting for the end of the epoch.

Battle-Tested Infrastructure

The Thetanuts Finance v3 Lending Market is inspired by Aave v2, a protocol that has proven its track record of security and resilience. This enhances security and safety for users in the system.

Additional Sources of Yield and Incentives

Thetanuts Finance v3 provides users with access to diverse sources of yield beyond the option premiums generated by Basic Vaults. These include lending interest from the Lending Market, trading fees from the AMM, potential $NUTS token incentives, and additional token incentives, bringing users more opportunities to maximize their returns.

Protocol Solvency

Basic Vaults in the Thetanuts Finance protocol are 100% collateralized. This can help reduce risk for users.

Free Market Pricing

Unlike other option protocols that rely on implied volatility (IV) as an input for option pricing, v3 employs free market pricing. This means that if users believe the AMM pricing is inaccurate, they can capitalize on arbitrage opportunities for profit.

$NUTS

The $NUTS token is a crucial element of the Thetanuts ecosystem. It is built to be a decentralized platform that is driven by the community, bringing benefits to owners through governance, value accrual, and liquidity incentives.

Here Comes Thetanuts V4

The upcoming V4 release represents a significant leap forward, introducing a novel architecture designed to enhance flexibility, liquidity, and overall efficiency within the options trading ecosystem.

The v4 upgrade is a shift from an Automated Market Maker (AMM) model to an RFQ model. Traditionally, AMMs have been employed to provide liquidity for options trading, relying on algorithms to automatically determine prices based on supply and demand.

However, this approach often lacks the flexibility required to accommodate complex or event-driven option structures.

The RFQ model, in contrast, operates through direct quoting by liquidity providers. This fundamental change allows for greater flexibility in pricing and fosters competition among liquidity providers, leading to tighter spreads and more competitive pricing.

Moreover, the RFQ model facilitates deeper liquidity by sourcing it directly from a wider range of market participants, including professional market makers and institutional investors.

Another defining characteristic of Thetanuts V4 is its chain-agnostic design.

Rather than being confined to a single blockchain ecosystem, V4 is designed to be adaptable and deployable across various platforms, including Ethereum Layer 2 solutions, modular chains, and emerging high-performance ecosystems.

This design choice is guided by three core principles: low transaction costs for efficient strategy execution, fast settlement times for smooth trading and payouts, and a vibrant DeFi ecosystem that fosters collaboration and composability.

Conclusion

Thetanuts Finance is a platform designed to empower users with the tools and resources they need to navigate the complex world of altcoin options.

Thetanuts Finance’s innovative v3 architecture, multi-chain approach, and focus on underserved altcoin markets position it as a promising player in the DeFi landscape.

By addressing the limitations of traditional AMM models and fostering a more flexible, efficient, and transparent trading environment, Thetanuts V4 will unlock new opportunities for both individual and institutional investors.

If you need to use advanced options trading strategies in the altcoin market, Thetanuts is worth a look!