[ad_1]

Optimism about the Bitcoin future outlook remains strong, with a crypto analyst forecasting a massive $100,000 price increase for the pioneer cryptocurrency. With expectations of an even greater price surge, the analyst believes that a $100,000 ATH for Bitcoin in 2025 is a nominal price target.

Why Bitcoin Will Rise To $100,000 In 2025

Luke Broyles, a prominent crypto analyst and Bitcoin enthusiast recently dived into a discussion about the relationship between Bitcoin’s price and inflation, specifically how the United States (US) inflation affects the value of the cryptocurrency over time. The analyst argues that by 2025, Bitcoin’s nominal price could reach $100,000 due to inflation. However, the extent of this price rally would barely reach levels seen in 2021.

Related Reading

Before making his $100,000 bullish forecast, Broyles predicted that Bitcoin could rise to $65,000 soon. He compared his projected price leap to Bitcoin’s price all-time high in 2021, which was above $69,000.

According to the analyst, the real value for the 2021 ATH, adjusted for inflation, is actually $83,000 in today’s market. This implies that even if Bitcoin’s current value surges to new levels around $65,000, the cryptocurrency would not have the same purchasing power it did in 2021.

Broyles has projected that in the next six to eight months, there will likely be more money printing, potentially increasing inflation further. Subsequently, he predicts that this rise in inflation could be a catalyst to pushing Bitcoin’s price to $95,000.

Commenting on the analyst’s predictions, a crypto community member questioned his analysis of Bitcoin’s future trajectory, highlighting that a $95,000 price increase was bearish.

Another crypto member claimed that inflation in the US is much higher than what is reported, stating that “the real Bitcoiners” believe that inflation is at least 21% per year, as such Bitcoin should be worth $210,000. Responding to the member, Broyles expressed skepticism about the 21% inflation claim but admitted that inflation could be as high as 12%, 14%, and 16% annually.

In a previous post, Broyles analyzed the current status of the Bitcoin bull market. According to the analyst, the market cycle is halfway through, with 50% of the expected timeline completed and 40% of potential returns achieved. Additionally, Bitcoin’s market sentiment has developed only 10% and Fear Of Missing Out (FOMO) has barely begun, at just 5%.

Analyst Predicts Next BTC Top

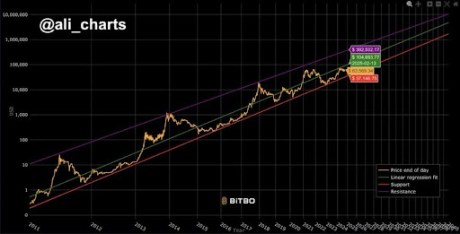

On September 24, crypto analyst Ali Martinez forecasted Bitcoin’s next market top in this cycle. According to Martinez, if Bitcoin’s Long Term Power Law holds true, the market can expect the cryptocurrency’s next peak to reach $400,000.

Related Reading

The Bitcoin Power Law is a concept or theory that suggests a specific mathematical relationship between the price of Bitcoin and its market behavior or adoption. As of writing, the price of Bitcoin is trading at $63,807, reflecting an 8.76% increase over the past week.

Featured image created with Dall.E, chart from Tradingview.com

[ad_2]

Source link