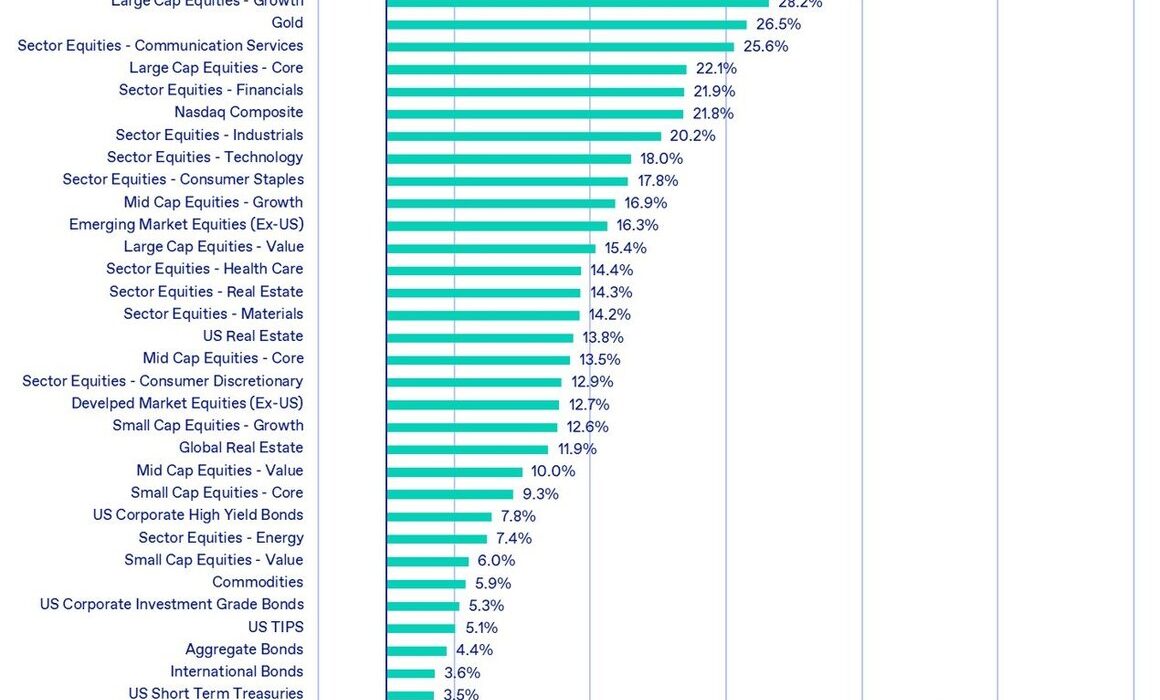

Bitcoin stays at the top of the charts as the best-performing asset in 2024 regardless of its stubborn consolidation.

It closed Q3 with a 2.5% rise, bouncing back from its earlier drop in Q2. Since hitting an all-time high in March, Bitcoin has stayed mostly rangebound.

The apex crypto traded between $70K and $54K for much of the past six months. It hasn’t broken out in any decisive direction.

Traditional assets perform better than Bitcoin in Q3

A lot of traditional assets did better as lower interest rates countered fears of a recession.

Stocks, which had a good run over the last few years, saw large-cap growth underperform while utility stocks, real estate, and small-cap value stocks had a better quarter.

Even gold was on fire, hitting new all-time highs, while Bitcoin remained stuck. Volatility has jumped this year. In August, the VIX hit levels that have only been seen three times in history.

Bitcoin’s behavior in Q3 was pretty much in line with its usual seasonal trends. The third quarter is usually the weakest for Bitcoin based on its median return, not skewed averages.

The slight 2.5% gain isn’t surprising. But September, which is usually BTC’s weakest month, saw a surprising boost this year.

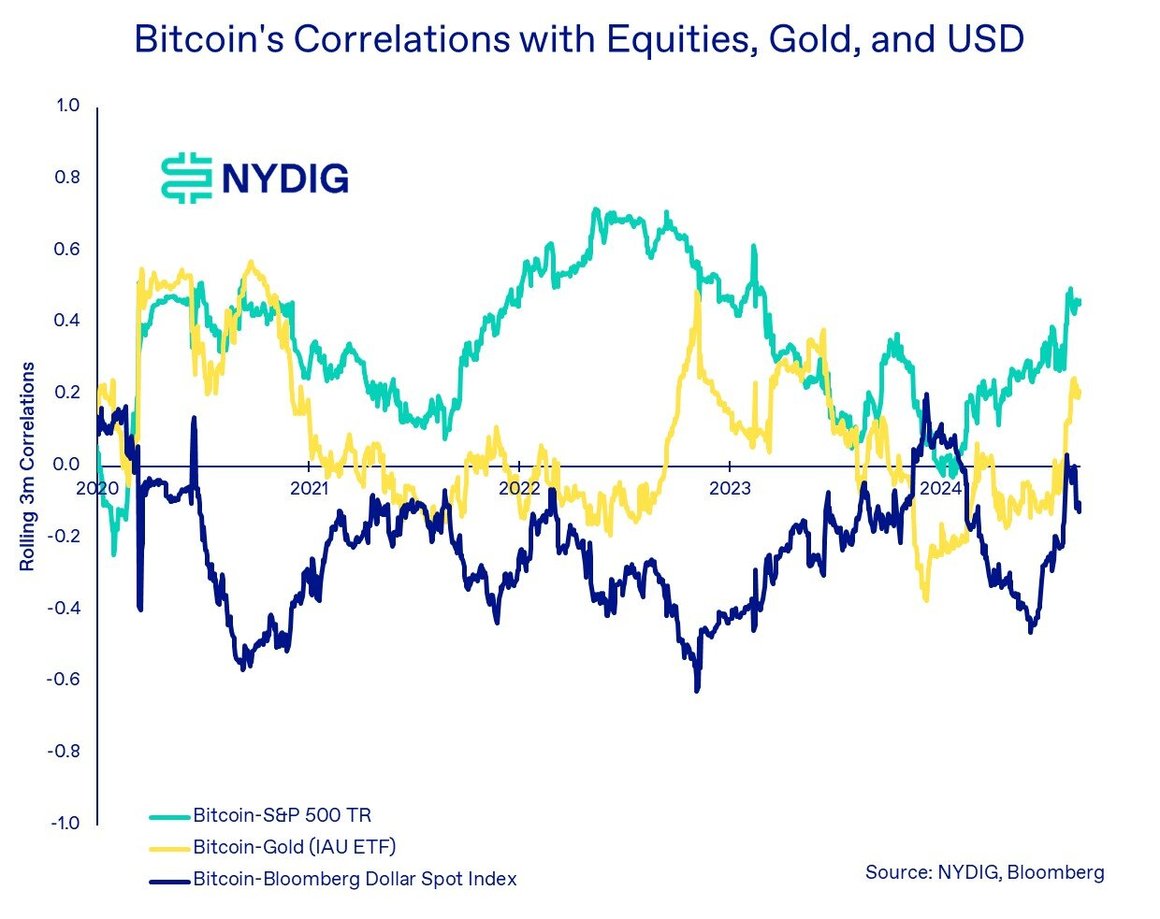

There’s also been a big rise in Bitcoin’s correlation with stocks. The rolling 90-day correlation hit 0.46 by the end of the quarter.

For those thinking Bitcoin is a leveraged version of U.S. stocks, that’s not quite right. Historically, its average 90-day correlation is 0.12. So this is not normal.

Major holders and sellers are in charge

The third quarter was also all about large holders either distributing or selling their Bitcoin. Mt. Gox and Genesis bankruptcies were finally closing, and governments were offloading forfeited Bitcoin.

About 204,000 Bitcoin changed hands, most of it happening at an average price of $62K per Bitcoin. That adds up to over $12.6 billion in trades.

Despite the huge amount of Bitcoin moving, there was little market impact. Creditors didn’t rush to dump their newly acquired Bitcoin. But the constant news of potential selling did hurt the market’s mood. A lot.

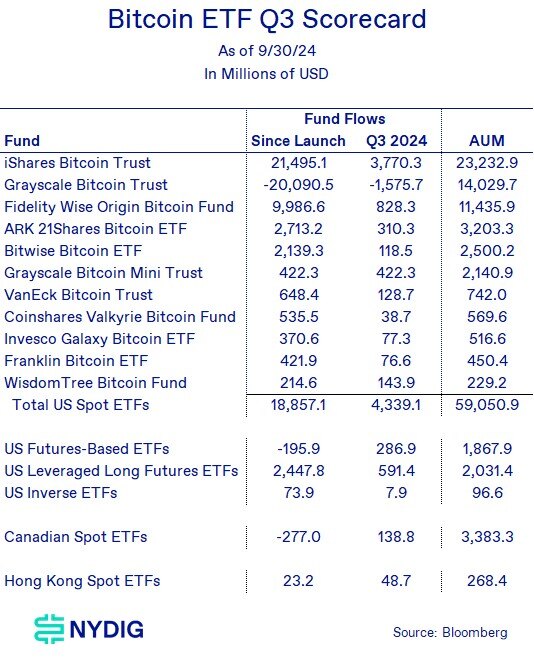

The market also saw the rise of spot Bitcoin ETFs as big BlackRock continued to add to their balances. In total, $4.3 billion flowed into the ETFs.

BlackRock’s iShares gathered 4.6 times more than its closest rival, Fidelity. Grayscale finally responded by launching its Grayscale Bitcoin Mini Trust, which has the industry’s lowest sponsor fee.

The fund attracted $422 million and landed solidly in third place, though Grayscale’s overall franchise took a hit. Even after all the outflows, the ETF still rakes in 2/3 of the industry’s revenue.

Crypto politics in America

Presidential candidate Donald Trump has been trying to win over the crypto crowd. In July, he showed up at the Bitcoin 2024 conference in Nashville, making a huge appeal to the community.

His connection to the crypto industry started earlier this year when he invited Trump NFT holders to his Mar-a-Lago resort.

And it was at this conference that he promised more, including setting up a “Bitcoin reserve” using forfeited Bitcoins.

It was a smart decision since 52 million Americans currently hold crypto, according to Stand with Crypto.

Kamala Harris hasn’t fully embraced the crypto industry as Trump has, but she’s got some pretty top elites in the industry lobbying for her right now, with the most notable one being Mark Cuban.

Either way, whoever wins, the industry is expected to do better than it did under Biden.

A Trump win would obviously bring bigger wins for crypto, but even if he loses, it’s unlikely he’ll fade into the background quietly. His active presence could benefit Bitcoin prices.

Corporates double down on Bitcoin

Corporate interest in Bitcoin kept growing during Q3. MicroStrategy, well known for its massive Bitcoin holdings, continued to issue convertible notes to buy even more. The company now owns 252,220 Bitcoin worth about $15.2 billion.

Marathon Digital bought $249 million worth of Bitcoin, funded through convertible notes. Other companies like Semler Scientific, Metaplanet, Cathedra, and OneMedNet either adopted Bitcoin treasury strategies or increased their holdings.

BNY Mellon got an exemption from the SEC’s controversial SAB 121, which requires public companies to report custodied crypto on their balance sheets.

But the real potential is in digital assets representing real-world assets (RWAs). Tokenized money market funds like BlackRock’s USD Institutional Digital Liquidity Fund and Franklin Templeton’s OnChain U.S. Government Money Fund.

Rate cuts and stimulus boost markets

September brought good news for markets when the Federal Open Market Committee (FOMC) cut interest rates for the first time since March of 2020.

While everyone was expecting a cut, the FOMC went further than anticipated, giving markets a solid boost. Bitcoin benefited from this, as did other assets.

Around the same time, the People’s Bank of China (PBOC) introduced several measures to kick-start its sluggish economy. Chinese stocks surged, and gold hit yet another all-time high.

Network activity on the Bitcoin network was quiet this quarter. The one exception was the launch of the Babylon staking protocol, which temporarily increased traffic and fees.

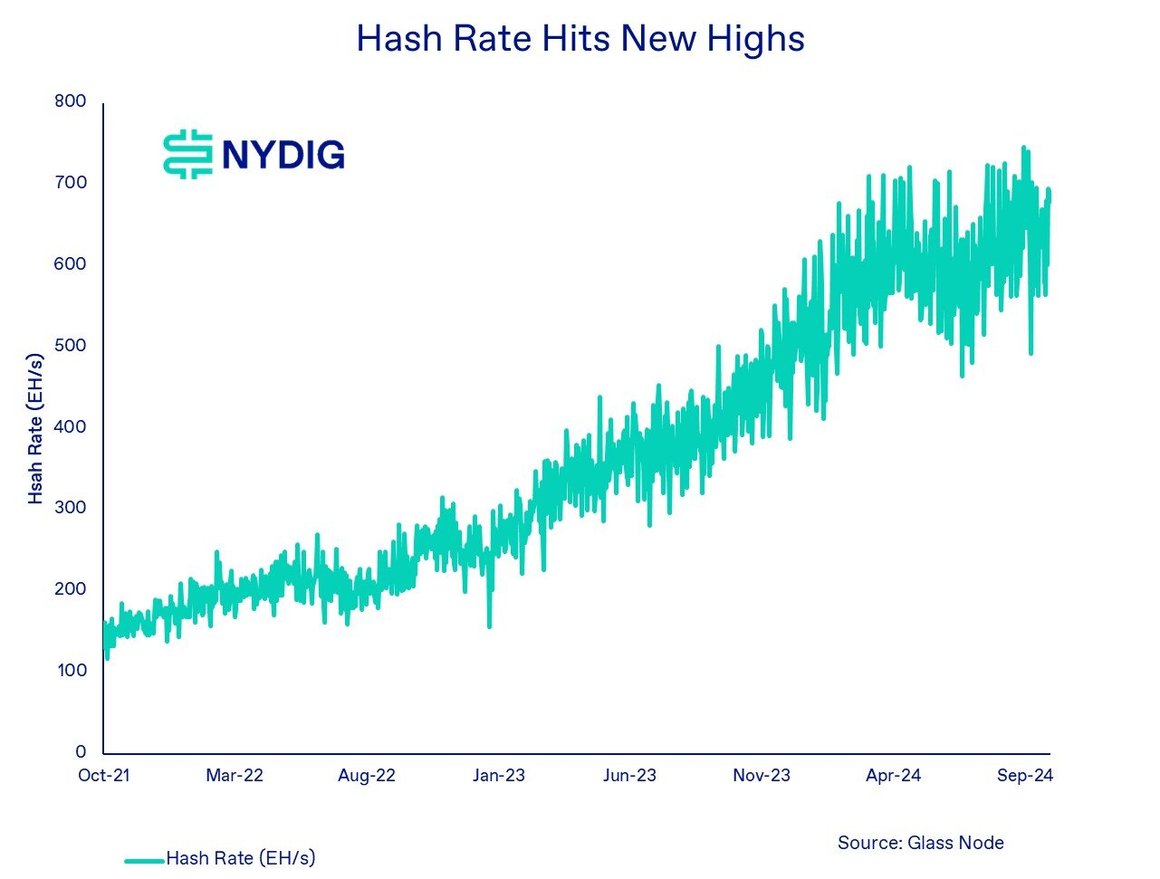

Miners are still adjusting to the halving that happened in April. That event caused a drop in difficulty, pushing uneconomical hash rates offline.

But public miners haven’t slowed down. They’re expanding their operations by acquiring more land and facilities, with some consolidation happening in the industry.

The storms and high energy prices during the summer have led to curtailment, but as fall approaches, the network’s hash rate is expected to grow.

A tense election ahead and more growth for Bitcoin

The upcoming presidential election is going to be the main event of Q4. Harris and Trump are neck-and-neck in the race.

If Trump wins, we can expect changes at the top of the SEC, with public enemy #1 Gary Gensler likely being replaced by someone more crypto-friendly.

Bitcoin ETF options are one step closer to being traded, with the SEC approving options on IBIT. The Options Clearing Corp (OCC) and the CFTC still need to approve the final steps, but it’s just a matter of time.

While there’s a chance this process could drag out like it did for palladium and platinum ETFs, the industry is confident that options on Bitcoin ETFs will get the green light by year-end.

At the same time, two new crypto assets (XRP and Solana) are also vying for the ETF status.

The SEC is currently in litigation against Ripple, the creator of XRP, and Solana has been labeled a security in lawsuits against Coinbase and Binance.

The global money supply continues to grow, driven by the U.S. and China’s looser monetary policies. While not a perfect correlation with Bitcoin’s price, there is a relationship.

Expansionary monetary policies should benefit a fixed supply asset like Bitcoin. The big sellers that have haunted Bitcoin markets in Q3 are now mostly out of the picture.

Most of the bankruptcies from 2022, including FTX, have paid back creditors. FTX distributions will be conducted in cash, and the Bitcoin it held is likely already converted.

Governments still hold $16.8 billion worth of Bitcoin. The U.K. is considering selling its $3.9 billion stash, but no solid plans have been made.

The U.S. government is expected to keep selling down its position, but the timing and amounts remain unclear. Q4 has historically been Bitcoin’s best quarter.