- BTC dropped 3.5% on Monday following Powell’s remarks on Fed rate cuts.

- The asset held above key short-term support at $63K, but will it continue to hold?

Bitcoin [BTC] and US stocks dropped during Monday’s, 30th September, intra-day trading session. BTC dropped 3% and hit $63000, which coincided with Fed chair Jerome Powell’s remarks on rate cut expectations.

During his Nashville address at the National Association for Business Economics conference, he showed no preference for a faster or slower pace of interest rate reduction.

He foresaw another two interest rate cuts, each 25 bps (basis points), before the end of the year.

“If the economy evolves as expected, that would be two more cuts by year’s end, for a total reduction of half a percentage point more.”

Market reprice Fed rate cut expectations

As of last week, the market expected an extra aggressive 50 bps cut in November, similar to the move seen in September.

However, at press time, interest rate traders priced higher odds of 25 bps at 61.8% following Powell’s remarks.

On the contrary, the chances of a 0.50% cut dropped to 38.2% from 53% seen last Friday, 27th September.

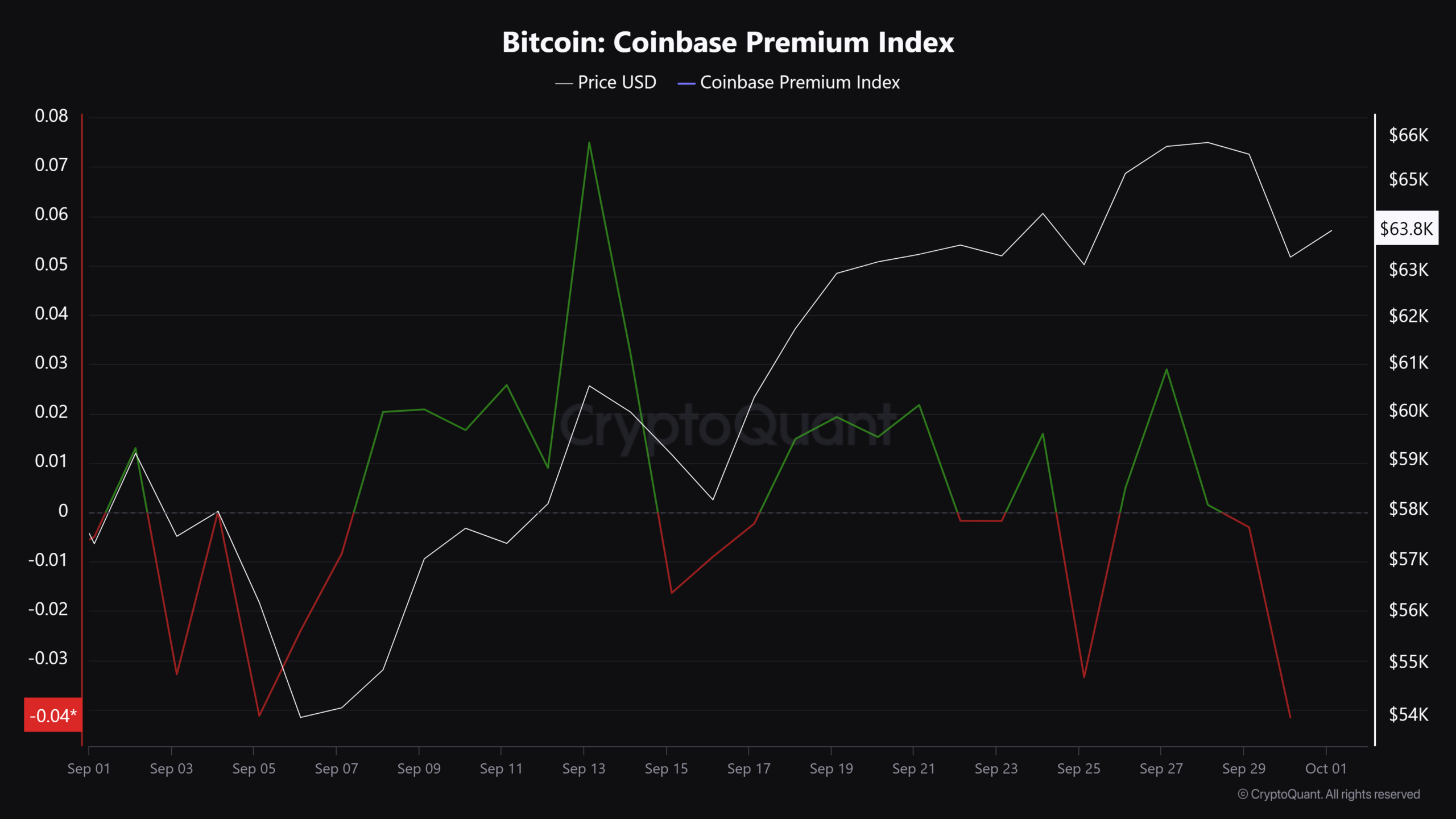

This has triggered a sentiment shift into the new week ahead of crucial US labor updates. Notably, US demand for BTC dropped from last Friday’s positive reading to a negative on 1st November, per the Coinbase Premium Index.

Compared to nearly $500 million daily inflows in US spot BTC ETFs last Friday, the products netted only $61.3 million on Monday, 30 September.

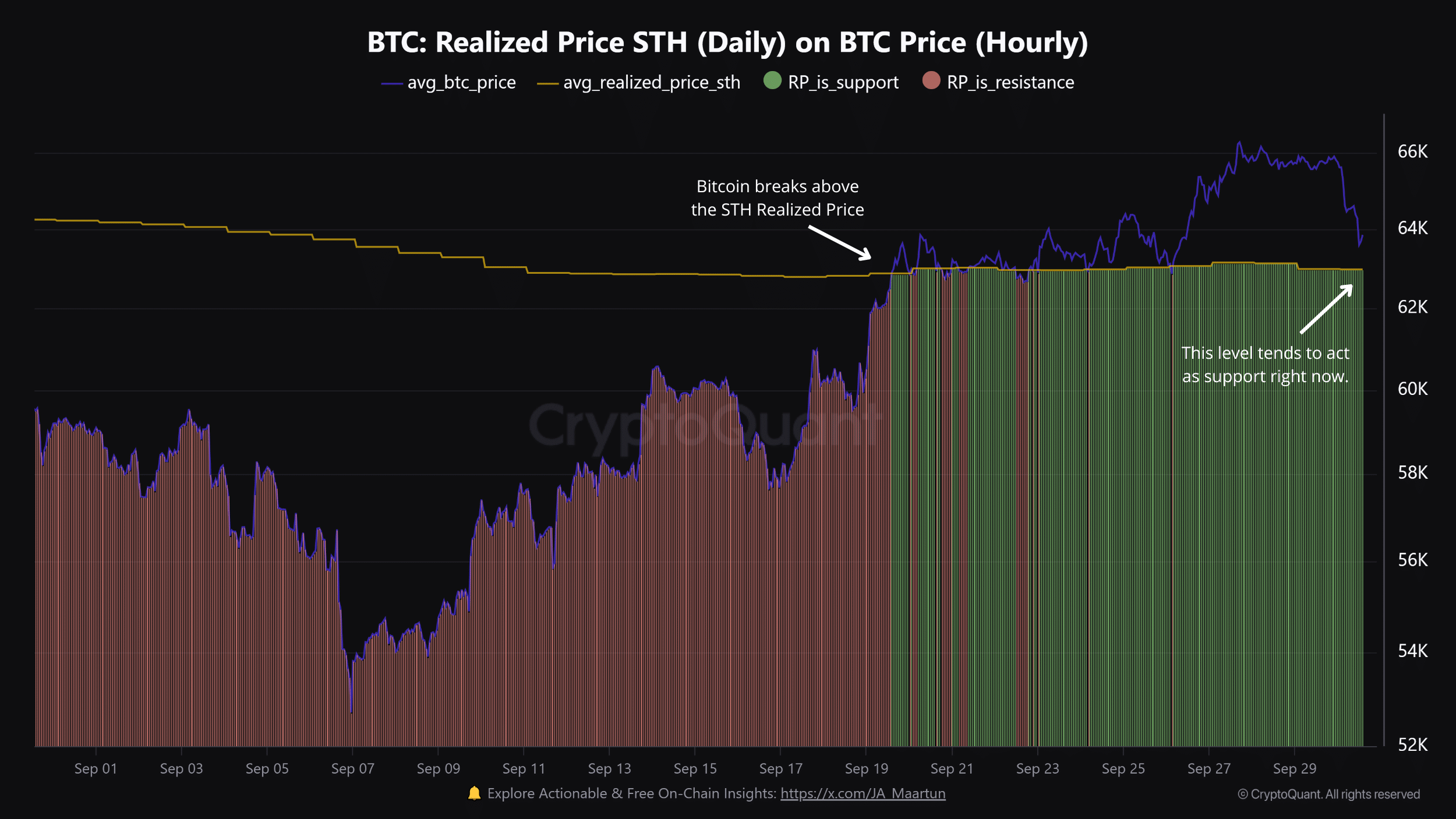

That being said, the $63K level could be crucial support in the short term. As noted by CryptoQuant, the level was the short-term holders’ (STH) realized price and has acted as support since mid-September.

At press time, BTC was valued at $63.9K ahead of crucial US labor updates.

Another potential positive catalyst was an increasing signal towards an end to the Fed’s quantitative tightening (QT) as more institutions tap into the Fed’s Repo facility. This could inject more Fed liquidity and boost risk assets.

However, increasing geopolitical tension in the Middle East could also challenge BTC’s Uptober expectations and is worth tracking.