- Bitcoin traders’ activity has declined as price consolidation persists.

- Bitwise cited historically weak summer and September seasons as the cause for BTC weakness.

Since early August’s massive sell-off, Bitcoin [BTC] has struggled to stay above $60K. The muted price action has persisted in the first half of September.

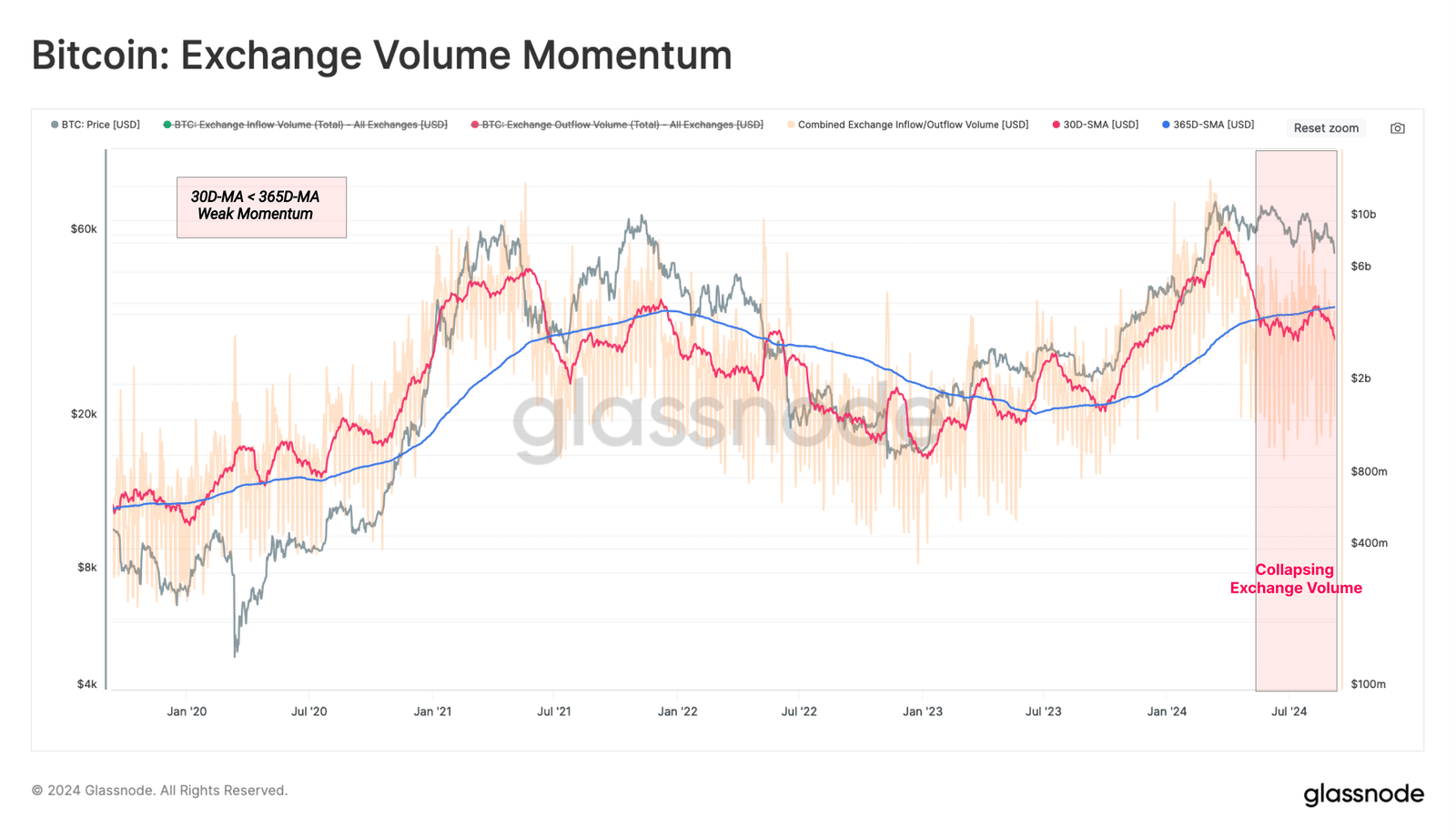

According to a Glassnode report, this weak price action has led to a “reduced trading appetite” from BTC traders. Part of its latest report cited low crypto exchange volumes and read,

“We can see that the monthly average volume has fallen well below the yearly. This underscores a decline in investor demand and less trading by speculators within the current price range.”

The report added that a crypto exchange is center of price discovery and speculation activity. So, a contracting volume on this front signaled weak demand from BTC traders and investors.

BTC selling pressure intensifies

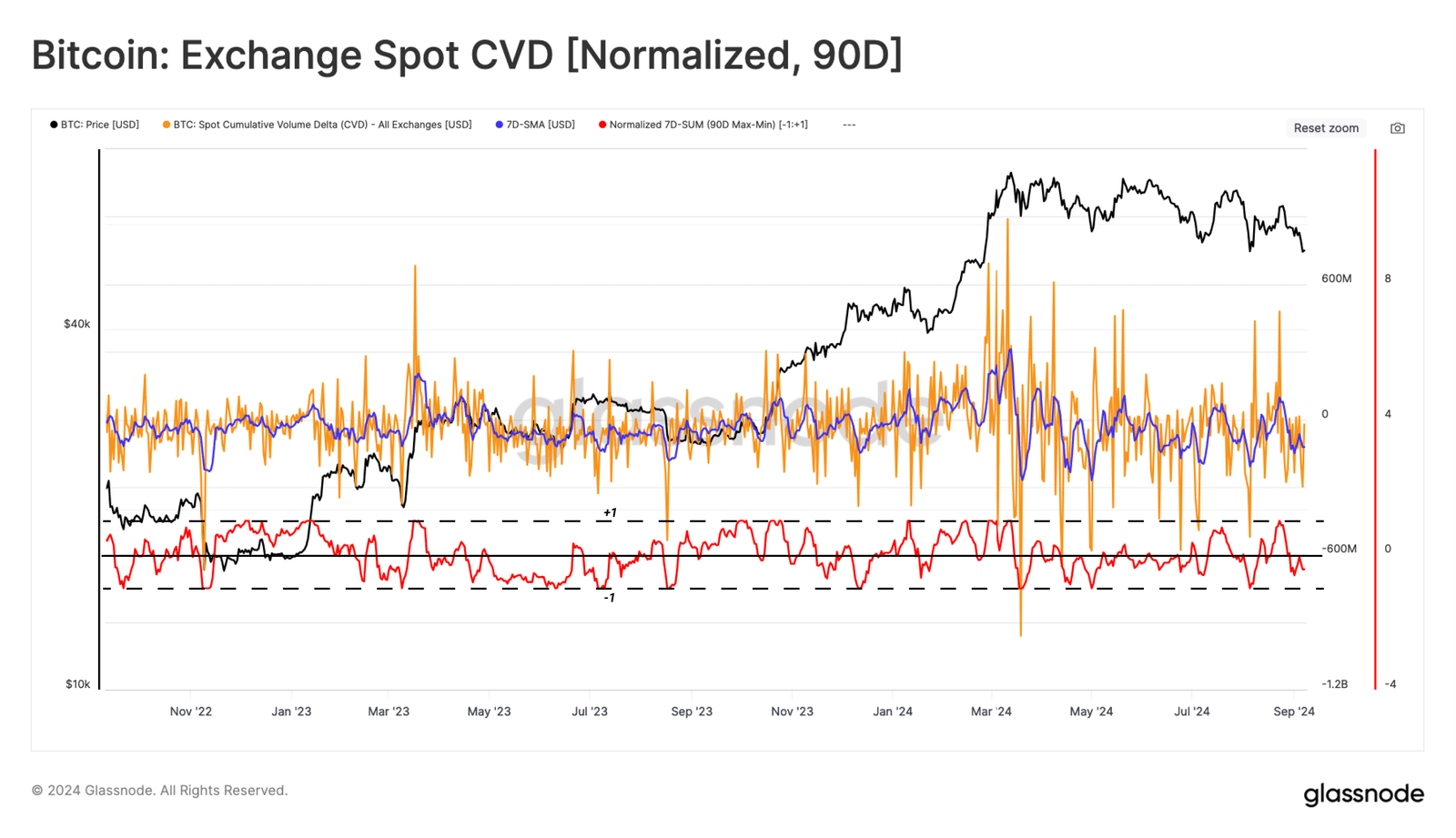

Glassode also noted that the spot market witnessed overall sell pressure in August and the entire quarter.

Using the spot CVD (Cumulative Volume Delta), which tracks the net balance between buy and sell volumes, the metric was overwhelmingly negative in Q3.

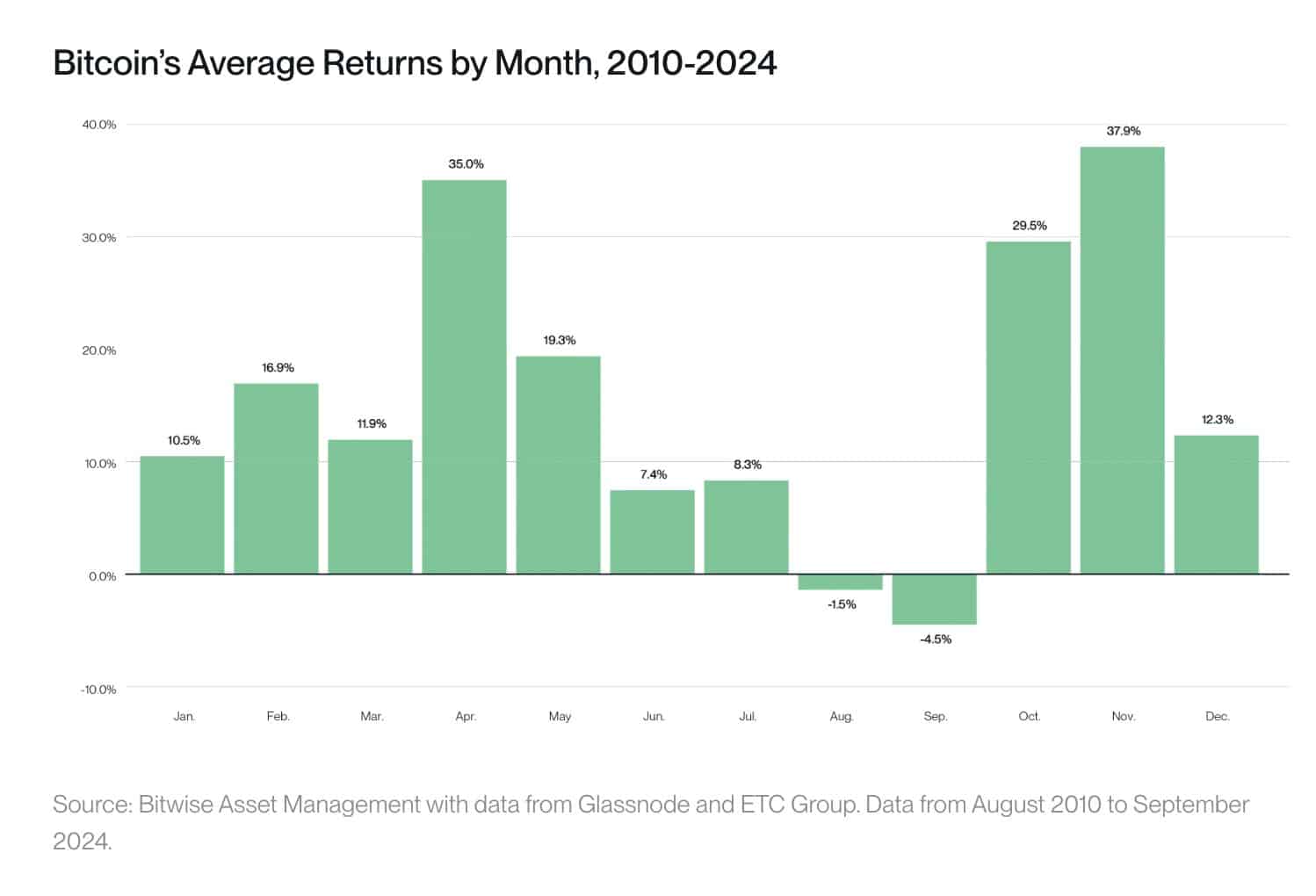

On its part, Bitwise cited seasonality as a likely factor in BTC’s weak performance and sentiment in Q3, particularly in September.

The asset manager illustrated that BTC has historically posted negative returns in August and September.

However, the firm noted a general trend of poor summer performance across all assets, as investors adopt the ‘sell in May and go away’ mantra.

That said, October has historically been a great month for BTC, with an average return of nearly 30%.

If the trend repeats, this might signal a strong rebound for BTC in Q4. However, according to crypto trading firm QCP Capital, there’s one caveat.

Per QCP Capital, the recent Trump-Harris debate showed no strong lead among the candidates and could trigger a risk-off event.

“The absence of a clear frontrunner in this election, coupled with the murky policy stances from both parties, heightens the possibility of a risk-off move in risk assets as we approach Election Day.”

At press time, BTC traded at $57k, a few hours before the US August CPI (Consumer Price Index) data.