A high-profile Bitcoin (BTC) whale prevented attacks on $120M in long positions. Longs were under pressure after BTC crashed from $66,000 and moved closer to $60,000.

The Bitcoin whale known as 2themoon6691.eth felt the pressure on long positions. Attacking leveraged positions at a certain price range was the main cause for the rapid unraveling of BTC under $66,000. The trader is one of the biggest single whales to be caught with threatened liquidation at one price level.

The whale managed to close $120M in longs, based on trading history. The total positions held reached $180M, with further potential for attacks. The positions were not directly liquidated but incurred significant costs. The whale used Hyperliquid, a fully decentralized perpetual futures market. Hyperliquid carries more than $352M in open interest in the BTC/USD pair. Hyperliquid carries above $1B in open interest on all futures markets, though still a fraction of Binance’s open interest at $6.8B.

The hyperliquid whale, however, avoided the worst of the liquidation, though with significant expenses. The whale absorbed $13M in current losses while paying $2M in funding fees to keep some of the remaining positions. The whale kept closing longs at $59,963 on the perpetual futures market.

According to Arkham research, the whale also holds more than $186K in various altcoins and tokens. The corresponding social media account for the whale has been deleted on X. The whale does not hold actual BTC but only uses the perpetual futures market to make bets on the BTC price direction.

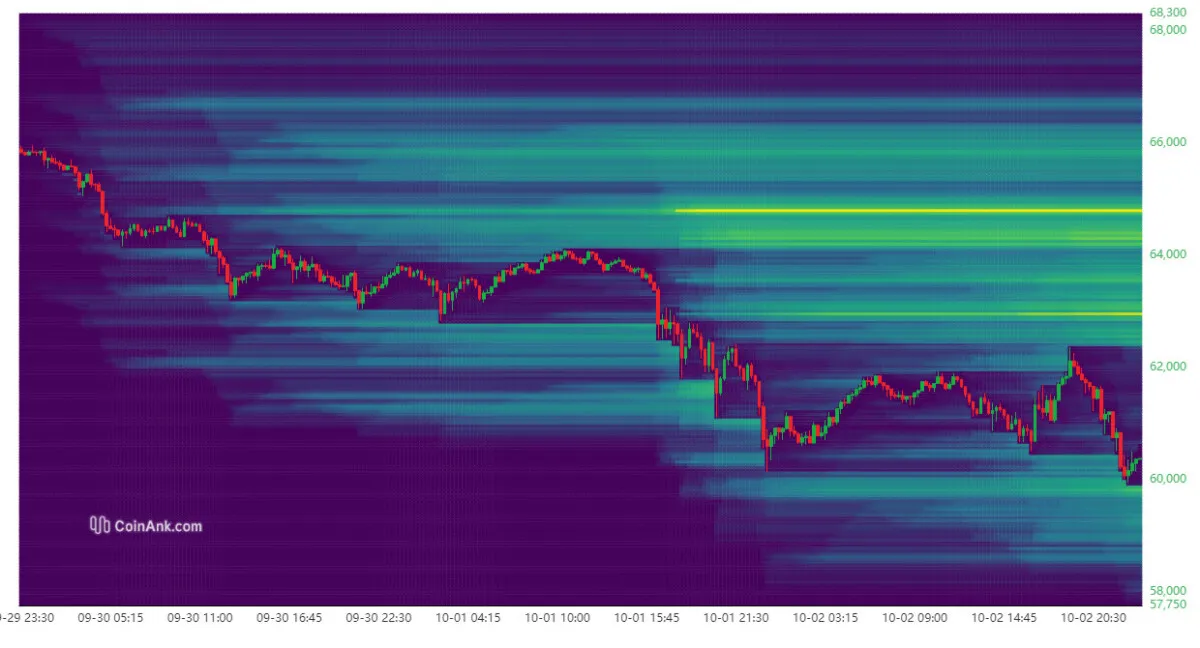

In the past day, all other traders exposed to leveraged positions were liquidated, for a total of over $560M. The market was considered over-leveraged at the beginning of October, after the positive September close. The liquidation heatmap showed BTC bounced from the $60,000 range just in time. The immediate level threatened by long liquidation shows a concentration of $324M in long positions at $59,850.

At this point, attackable short positions are holding a greater weight, potentially causing a price reversal.

BTC continues dipping even after clearing long

BTC continued to show price weakness, sinking to $60,296.18. The leading coin retained its dominance of 56.7% of the entire market, as Ethereum (ETH) and altcoins slid even faster.

Liquidation heatmaps show accrued long positions in the $59,000 range, which may lead to an ongoing price dip under $60,000. Some of the positions may be closed before the price dips to that range.

Open interest sank from more than $19B as of October 1, down to $17.6B. Long liquidations exceeded $40M in the past 24 hours, with $10.83B only on Binance. Despite the trading attacks, long positions still dominate and the long-to-short ratio is growing. Funding rates are back to positive, with the exclusion of Bybit.

Liquidation heatmaps also position BTC in a range between $58,000 and $64,000, though the most liquidity in leveraged positions is locked in an even tighter range of around $60,000. Some of the positions may be closed before liquidation, but erratic price moves may sweep the over-leveraged positions.

The Bitcoin open interest also briefly surged to around $20B, a level that historically corresponds to local tops. In the past three months, local tops appeared three times with open interest close to $20B.

The BTC signals are conflicting, as recently BTC also had a bullish higher price move. For now, the consensus is that the market may be over-leveraged and the main driver of price action is the sweeping of leveraged positions. An over-leveraged market can work in either direction, but will always create pressure to normalize, often switching the BTC price trend.

Cryptopolitan reporting by Hristina Vasileva