Key takeaways

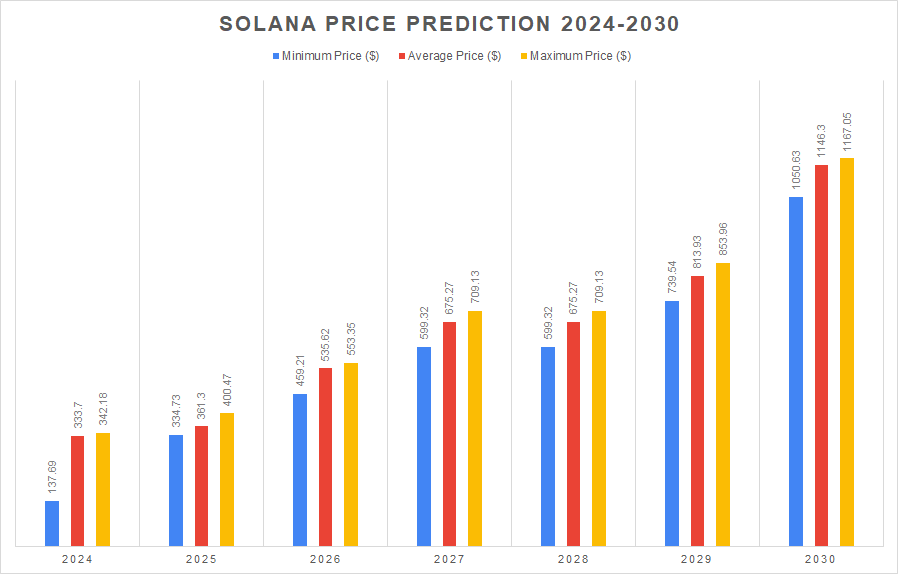

- Solana’s price struggled to cross $160 in June but is expected to surpass $342.18 by the end of 2024.

- By 2027, SOL is expected to reach a new high of $709.13, driven by mainstream adoption of its dApps.

- Solana’s price could surpass the $1,000 mark or higher by 2030.

Despite occasional challenges, including network congestion and competition from other blockchain platforms, Solana demonstrates resilience and adaptability, positioning itself as a leading player in the decentralized finance (DeFi) and Web3 landscape.

Overall, the prevailing sentiment within the Solana community is one of confidence and excitement, with stakeholders eagerly anticipating the platform’s continued evolution and impact on the broader crypto ecosystem. While uncertainties persist, Solana’s innovative approach and robust infrastructure instill optimism for its future price trajectory and market dominance. How high can SOL go in 2024 and beyond? Let’s find out.

Overview

| Cryptocurrency | Solana |

| Token | SOL |

| Price | $143.75 |

| Market Cap | $74,997,070,375 |

| Trading Volume 24-h | $1,667,203,520 |

| Circulating Supply | 468,932,799 SOL |

| All-time High | $260.06 Nov 07, 2021 |

| All-time Low | $0.5052, May 12, 2020 |

| 24-h High | $161.62 |

| 24-h Low | $155.24 |

Solana price prediction: Technical analysis

| Volatility | 2.24% |

| Sentiment | Bullish |

| 50-Day SMA | $141.86 |

| 200-Day SMA | $154.84 |

| Price Prediction | $349.09 (118.13%) |

| F & G Index | 22.47 (extreme fear) |

| Green Days | 16/30 (54%) |

| 14-Day RSI | 69.25 |

Solana price analysis

TL;DR Breakdown

- The Solana price analysis is bullish today.

- Strong support for SOL/USD is present at $150.

- The resistance level is seen at the $160 level.

The Solana price analysis for October 1 shows that the bulls rose to the $160 mark but were rejected at that level as the price fell back to the $150 support. The broader cryptocurrency market observed bullish sentiment over the last 24 hours as most major cryptocurrencies recorded positive price movements. Players like ADA and ETH recorded a 8.40 and an 5.50 percent decline, respectively.

Solana price analysis 1-day chart: SOL falls back to $148 after rejection at $160

The 24-hour SOL/USD price chart indicates high volatility. The price action rose rapidly towards the $160.00 mark but failed to cross the level. It fell rapidly to the $120.00 mark before rising to the $130.00 mark, where it consolidated. This week, the asset rose to the $160 mark but failed to overcome the resistance level and fell back to $148.

The MACD is bullish at 0.93 units, moving towards a lower level, while the EMAs are at the mean position, and their gradient becomes lower as the price level retraces. The RSI also shares this sentiment, as the indicator fell to 52.14 from above the 60.00 index level. The diverging Bollinger Bands suggest increasing volatility, indicating that the $150.00 support may not hold for the week. Collectively the indicators suggest rising bearish momentum.

SOL/USD 4-hour price chart: Will the consolidation continue?

The 4-hour price chart of SOL shows a steady consolidation around the $130 mark as either side struggles to gather momentum. The bears were stopped at the $120 level, and the bulls recovered to the $130 mark, where the price hovered until recently as the bulls generated positive momentum. However, after the rejection at $160, the price instantly returned to the $150 mark.

The RSI is at 35.87, suggesting that the asset is in the bottom part of the neutral region, which indicates low room for further short-term movement for the bears. However, the downward slope suggests the bears may continue to gain momentum in the short term. The MACD shows a steady selling pressure, with the MACD line at -1.02, showing steady bearish dominance across the 4-hour charts. These indicators collectively suggest a forming bearish trend.

Solana technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $ 152.87 | SELL |

| SMA 5 | $ 153.60 | SELL |

| SMA 10 | $ 152.46 | SELL |

| SMA 21 | $ 146.69 | BUY |

| SMA 50 | $ 142.30 | BUY |

| SMA 100 | $ 147.95 | SELL |

| SMA 200 | $ 146.78 | BUY |

Daily exponential moving average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $ 144.81 | BUY |

| EMA 5 | $ 143.43 | BUY |

| EMA 10 | $ 143.72 | BUY |

| EMA 21 | $ 147.13 | SELL |

| EMA 50 | $ 151.18 | SELL |

| EMA 100 | $ 151.20 | SELL |

| EMA 200 | $ 140.17 | BUY |

What to expect from Solana price analysis?

Solana’s price analysis shows that it faced resistance around the $160 level and crashed to the $110 mark before finding strong support. Since then, the bulls have managed a return to the $158 mark, but the sentiment remains bearish.

Traders should expect Solana to continue its bullish rally as the $160 resistance weakens with the bullish persistence. As such, the price can be expected to hover between the $155-$170 range across the next few days as the buying pressure increases. On the other hand movement below $150 may mean a drop to the $145 mark, but further downward movement is unlikely, given the current market sentiment.

Is SOL a good investment?

Solana is a high-performance blockchain platform known for its scalability and speed, boasting a substantial Total Value Locked (TVL). The network continues to hit key development milestones. Despite a challenging month, price predictions indicate a more optimistic outlook, suggesting potential for future growth.

Why is SOL down?

Solana’s price failed to climb past the $160 resistance level, and the following bearish rally fell to the $150.00 mark where it currently hovers.

Will SOL recover?

Solana price is expected to recover swiftly as investors buy the dip on many major altcoins across the crypto market. However, the bulls need to weather the current bearish pressure so a recovery should be expected my mid-August at the earliest.

Will SOL reach $200?

Solana is undergoing a high-volatility period that may see it reach the $200 mark before the year closes.

Will SOL reach $500?

The Chance of SOL reaching the $500 mark depends on various circumstances such as future network development, market regulations and the broader growth of the cryptocurrency market. If Solaba continues on its current trajectory, it can reach $500 in the next decade by cementing its position as one of the forerunner platforms for dApps.

Does SOL have a good long-term future?

Yes, Solana has a good long-term future due to its high scalability, low transaction costs, and robust ecosystem. Its growing adoption, strong developer community, and strategic partnerships further enhance its potential for sustained growth.

Recent news/updates on Solana

Ryan Lee, Chief Analyst at Bitget Research made the following statements regarding Solana’s future.

Based on the current market sentiment, the development of the Solana ecosystem, and the involvement of major partners, SOL is expected to be more bullish than bearish in October. SOL may reach or exceed the price range of $160 to $180 in October.

(1) Since the beginning of this year, SOL has shown stronger stability amid the ups and downs of the broader market. During market downturns, the $110 support level has been exceptionally strong, and during each rebound, SOL has been one of the strongest performing high-market-cap tokens. The Solana ecosystem’s meme sector has also consistently been one of the most robust during rebounds. Market confidence in Solana as a whole has gradually increased over the past year.

(2) At the Solana Breakpoint 2024 event, many project teams announced new plans and major product iterations, such as Solayer’s partnership with OpenEden to launch the yield-stablecoin SUSDC, Coinbase’s spokesperson revealing that cbBTC will run on the Solana blockchain, and Sanctum launching a new PayFi product. The prosperity of the ecosystem depends on the development of Dapps, and these initiatives lay a solid foundation for the long-term growth of the Solana ecosystem.

(3) The support from Franklin Templeton and Citibank is also a significant positive development. Franklin Templeton’s plan to issue a mutual fund on the Solana network is particularly important for increasing Solana’s appeal to institutional investors.

Solana price prediction October 2024

A bullish start to October 2024 saw SOL rise from $150 to $160 in the last days of September. Moreover, the market may soon continue the bullish rally pushing SOL towards $180. Based on expert analysis, Solana (SOL) could reach $254.09 by the end of September.

| Month | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| September | 130.20 | 155.70 | 254.09 |

Solana price predictions 2024

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2024 | 137.69 | 333.70 | 342.18 |

At the beginning of 2024, the price of cryptocurrencies recovered, but recent events have shown that bears are now in control of price dynamics, slowing growth. Solana (SOL), which has seen its value fall by 3.16% today, has also been affected by this trend. Experts expect that SOL might reach a maximum price of $342.18, an average price of $333.70, and a minimum price of $137.69.

Solana (SOL) price prediction 2025-2030

| Year ($) | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 334.73 | 361.3 | 400.47 |

| 2026 | 459.21 | 535.62 | 553.35 |

| 2027 | 599.32 | 675.27 | 709.13 |

| 2028 | 599.32 | 675.27 | 709.13 |

| 2029 | 739.54 | 813.93 | 853.96 |

| 2030 | 1050.63 | 1146.3 | 1167.05 |

Solana price prediction 2025

Solana’s price is predicted to reach a lowest possible level of $334.73 in 2025. Experts suggest that the coin’s price could reach a maximum value of $400.47 and an average price of $361.30.

Solana price prediction 2026

In 2026, the price of Solana is forecasted to be at around a minimum value of $459.21. Solana’s price can reach a maximum of $553.35 and an average trading value of $535.62.

Solana price prediction 2027

If the bullish run from the previous years carries on to 2027, SOL can reach a minimum price of $599.32, a maximum price of around $709.13. On average, the trading price might be $675.27.

Solana price prediction 2028

An analysis of the historical performance of SOL shows that the coin could attain new highs in 2028, reaching a maximum price of $709.13, a minimum of $599.32, and an average trading price of $675.27.

Solana price prediction 2029

Based on the Solana price prediction for 2029, investors can expect a maximum and minimum SOL price of $853.96 and $739.54. On average, SOL could trade at $813.93.

Solana price prediction 2030

Solana’s price is projected to reach a minimum price of $1,050.63 in 2030. Expert findings suggest that SOL’s price could reach a maximum of $1,167.05 and an average forecast price of $1,146.30.

Solana market price prediction: Analysts’ SOL price forecast

| Firm | 2024 | 2025 |

| Gov.Capital | $206.33 | $257.52 |

| DigitalCoinPrice | $386.56 | $361.30 |

Cryptopolitan’s Solana (SOL) price prediction

Our predictions show that SOL will achieve a high of $381.93 in the second half of 2024. In 2025, it will range between $288.74 and $345.45, with an average of $311.66. In 2030, it will range between $906.29 and $1,006.72, with an average of $988.82. Note the predictions are not investment advice. Seek independent professional consultation or do your research.

Solana (SOL) historic price sentiment

- Solana was launched in April 2020 and has gained popularity over the last 18 months. Its price has surged from $0.75 to a high of $214.96 in early September.

- Following NFT hype and growing demand in the DeFi community, the cryptocurrency Solana (SOL) price more than tripled during the summer of 2021. Solana (SOL) token became the fastest-growing cryptocurrency and is currently ranked fifth with a live market cap of nearly $66 billion.

- 2022 saw Solana leap to its all-time high of $260, but SOL failed to close the year anywhere near that high, as the price came crashing down to below $40 by June. The bearish markets were marked by high skepticism as trading volumes declined throughout the crypto markets.

- The price continued to trade below the $40 level until November 2023, when Solana gained momentum and started a bullish rally again to close the year at $101.84.

- It has overtaken the once-popular Dogecoin, DAI, DASH, Polkadot, VeChain, Eos, etc. It is closely behind Binance Coin (BNB) and Tether (USDT).

- In 2024, Solana has become the go-to platform for many De-Fi applications, including decentralized exchanges, NFTs, and more. The success has been visible in the SOL price, which has risen from low of $83.62 in January to the recent high of $202.87

- In June, SOL struggled to maintain grip of the $165 level, and the price action was retraced to the $155 mark. However, the bullish pressure is high at the price region as buyers fight to regain the $160 level.

- In July, Solana (SOL) maintained a trading range of $146 to $179. At the time of writing, August 2024, Solana (SOL) traded around $137 – $151 while in September the asset has traded around the $131 price level as SOL struggles to initiate a trend in either direction.

- In October, Solana is expected to make noticeable gains as industry experts estimate a rise to the $180 mark.