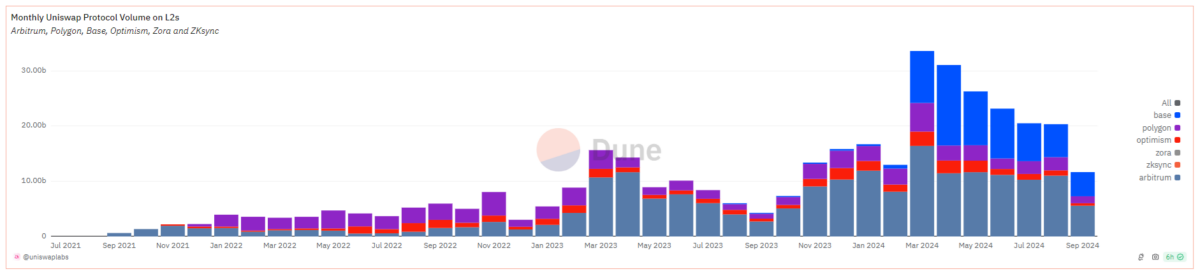

Uniswap is growing its presence on L2 chains, despite fears of a slowdown in September. The past 12 months marked a switch to L2 due to the demand for more favorable fees.

Uniswap V3 increased its presence on L2 chains in the past 12 months. For September, the leading DEX marked triple the volumes compared to the same month last year. Uniswap carried $11.68B in swaps, compared to $4.29B for September 2023.

During that time, Uniswap expanded its presence to a total of 23 chains. The dominant ones continue to be Base and Arbitrum, due to low fees and active marketing. Soon after its launch, Base started displacing liquidity pools for Ethereum, mostly due to the creation of meme tokens.

As a result of the DEX liveliness, Uniswap reached $43.28M in monthly fees. While Uniswap saw a slowdown in September, the last few months were the most successful in the history of the DEX. The rapid inflow of users on Base turned Uniswap into the leader for meme token swaps.

The past year also saw Uniswap expand on the Celo protocol. Celo is still an L1 but may transform into an L2 to better align with the culture of Ethereum (ETH).

Uniswap’s growth on L2 reached more than 20X since 2021. For 2024, Uniswap will have to break its own record of $192B in annual trades. At the same time, Ethereum remains the layer that still carries $3.72B in value locked, due to legacy pools and pairs. Ethereum is still the biggest source of stablecoins, despite the inflows of USDT into Arbitrum and other L2.

Arbitrum leads in volumes, but Base has the most pools

Uniswap’s success hinges on carrying both large-scale volumes and multiple small pools. Arbitrum is the leader in terms of volumes, with more than $211M in daily activity.

On Arbitrum, Uniswap V3 carries 251 coins in 485 pairs. The same version on Base reflects much more active token minting, with 338 coins and tokens in 694 total pairs. One of the biggest problems for Base is the presence of low-liquidity pairs. A few dozen addresses on Base have indeed boosted traffic, but mostly through low-quality rug pulls.

The last few months saw the creation of multiple pools, most now inactive. While expansion on Base is seen as a positive for Uniswap, the presence of unverified tokens and just-launched pools is skewing the real trading picture.

Uniswap competes with Aerodrome in terms of value locked. Aerodrome aims for high liquidity pairs, while Uniswap offers a wider selection of tokens. As of September 25, Uniswap locks $215M in value in its Base version and is the second most active app.

On Arbitrum, the Uniswap V3 pools contain $291.99M in all liquidity pairs. Uniswap is the biggest DEX on the L2 chain, outcompeted only by GMX perpetuals and Aave’s lending pools.

Uniswap is still the top Ethereum gas burner

Despite the shift to L2, Uniswap still relies on Ethereum. The Uniswap routing service is the most used L1 smart contract. Fees on Uniswap reached about $45K per hour, or $896K in the past 24 hours.

Ethereum itself carries 37.7% of all DEX volumes, for both major and niche markets. WETH is still the most influential asset for pairings, along with USDT and USDC. The presence of bridged or native stablecoins on L2 further boosted decentralized volumes in 2024.

Uniswap now has to face the competition of other DEX that have also grown in the past year. The leading market still has a 45% share of the entire DEX market. Other hubs like Aerodrome are quickly catching up with a share of 20.6%.

CurveDEX is also building up its volumes, already carrying $1.78B in liquidity. DEXs are already adding features for targeted liquidity, a tool that allows minimal slippage in a predetermined price range.

As Uniswap prepares to launch V4 pools, the UNI token is still in consolidation. UNI traded near its one-month high at $6.84, though still far from the year’s peak at $15.20. UNI still awaits a breakout, with $20 a possibility during a bull market. UNI also completed all token unlocks as of September 18, abandoning one source of potential price pressure.

Cryptopolitan reporting by Hristina Vasileva