MicroStrategy bought 5,262 BTC for $561 million. The company acquired the BTC at an average cost of $106662 per coin. With this addition, it takes its total BTC holdings to 444,262, bought for $27.7 billion at an average cost of $62,257 per coin.

This makes it the seventh time in seven weeks that MicroStrategy has invested in Bitcoin-related assets related to its Bitcoin Strategy. The company is still regularly receiving the cryptocurrency, and its price has remained slightly constant in the past one or two weeks.

Nasdaq Listing of Coincides with the Purchase

MicroStrategy, a company that recently joined the Nasdaq-100 index, has made another purchase of Bitcoins. This list is partially explained by the fact that the company has been focused solely on Bitcoin, which has greatly impacted its expansion.

Currently, the firm’s Bitcoins have delivered huge profits; the unrealized profits are around $15 billion. On the other hand, the company’s stock, known as MSTR, has rallied by 470 % year to date and outperformed major asset and stock market players after the company adopted a bitcoin strategy in 2020.

Market Reaction To The Announcement

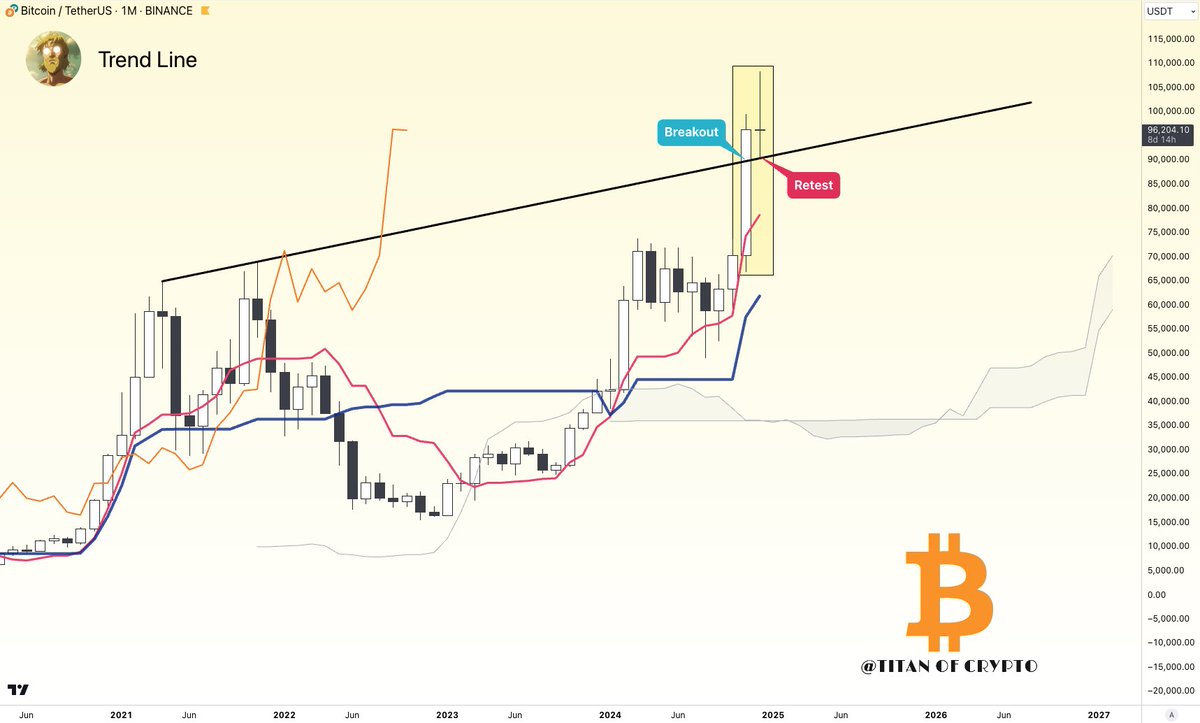

In the same month, however, the MicroStrategy stock experienced a slight drop; the rate reduced slightly to $359, a 1.9% drop. The price of Bitcoin also floated in the $94,000 to $96,000 range, as seen with its recent trend.

Market analysts have noted that Bitcoin is still in the bull market as long as it maintains support above the $85000 and $90000 region. If Bitcoin continues to slide under $16,500, MicroStrategy is in very deep, as CryptoQuant CEO Ki Young Ju has described.

Where Long-Term Bitcoin Strategy is Concerned

MicroStrategy’s Bitcoin purchases are an aspect of a larger campaign to incorporate cryptocurrency into its business model. It remains positive on Bitcoin whether the market trend is going up or down, as evidenced by the constant diversification of its campaigns.

Such a strategy has generated interest in the financial and cryptocurrency industries, with certain analysts praising the company’s vision while others have noted that the nature of cryptocurrency investments is very volatile.

MicroStrategy’s continued voracious purchase of Bitcoins puts it out as one of the significant industry players leverages heavily on digital currency prospects.