- BTC has declined by 3.64% in 24 hours.

- An analysts predicts a further decline, if $55355 support fails to hold.

Defying market trends, Bitcoin [BTC] saw a green September. However, the last two days it has experienced a sharp decline. As of this writing, Bitcoin was trading at $61,407. This marked a 4.31% decline on weekly charts.

Prior to this, BTC was on an upward trajectory hiking by 5.99% on monthly charts. However, since hitting a high of $66,508, it has declined to reach a low of $60,164.

This recent price movement has sparked widespread discussion within the crypto community. Inasmuch, popular crypto analyst Man of Bitcoin suggested a potential decline citing ABC structure on Elliot’s wave -B.

What the analysis shows

The analyst posited that BTC has broken a micro support which could result in further decline.

According to this analysis, the market is bearish which would result in two scenarios.

The first scenario is that BTC will form an ABC correction where Wave-A has started and the prices are declining. The key here is that Wave-B will fail to push the price above previous highs. Therefore, in this scenario, the BTC would hold its support above $55,355.

However, in second scenario Bitcoin will break below the $55,355 support level thus entering a five-wave structure to the downside, indicating a much steeper decline.

The analysis provided by ManofBitcoin suggests a potential downside following the recent price movement. However, it’s essential to determine what other fundamentals suggest.

For starters, Bitcoin’s Price DAA divergence has remained negative over the past week. This suggests that the current price BTC rally is not supported by fundamentals as on-chain activities have declined.

Such market condition implies that the price growth is unsustainable as it signals a lack of confidence and fading interest.

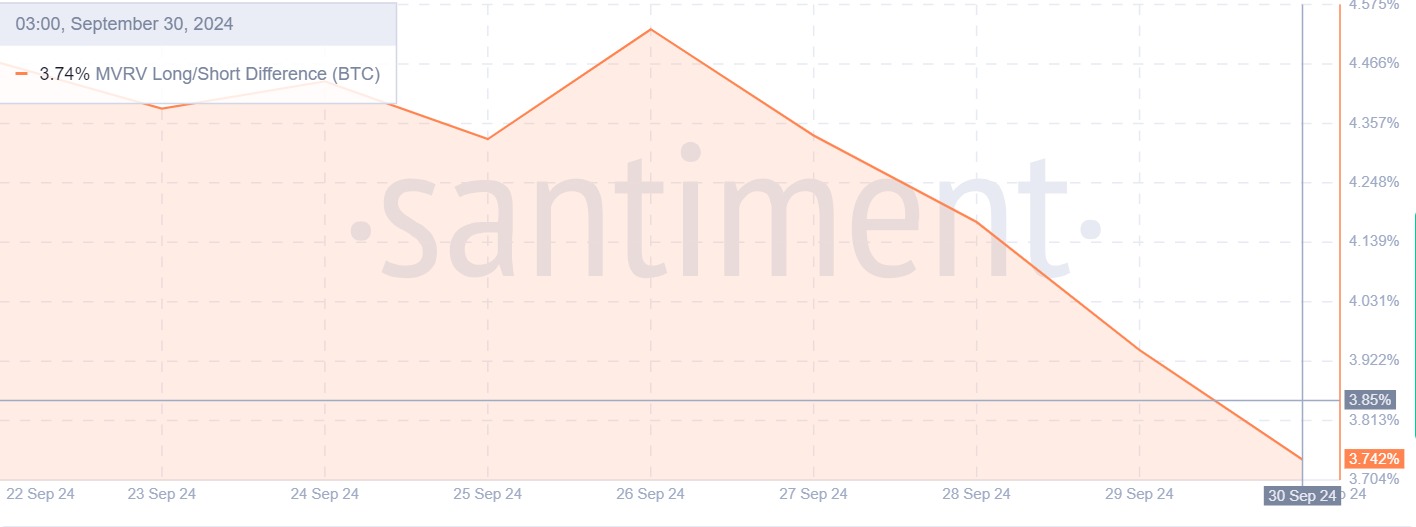

Additionally, MVRV’s long/short difference has declined over the past week from a high of 4.5% to 3.7%. Such a decline suggests that the market is in a stage where long-term holders, are no longer willing to hold as much, and short-term holders might be selling to avoid losses.

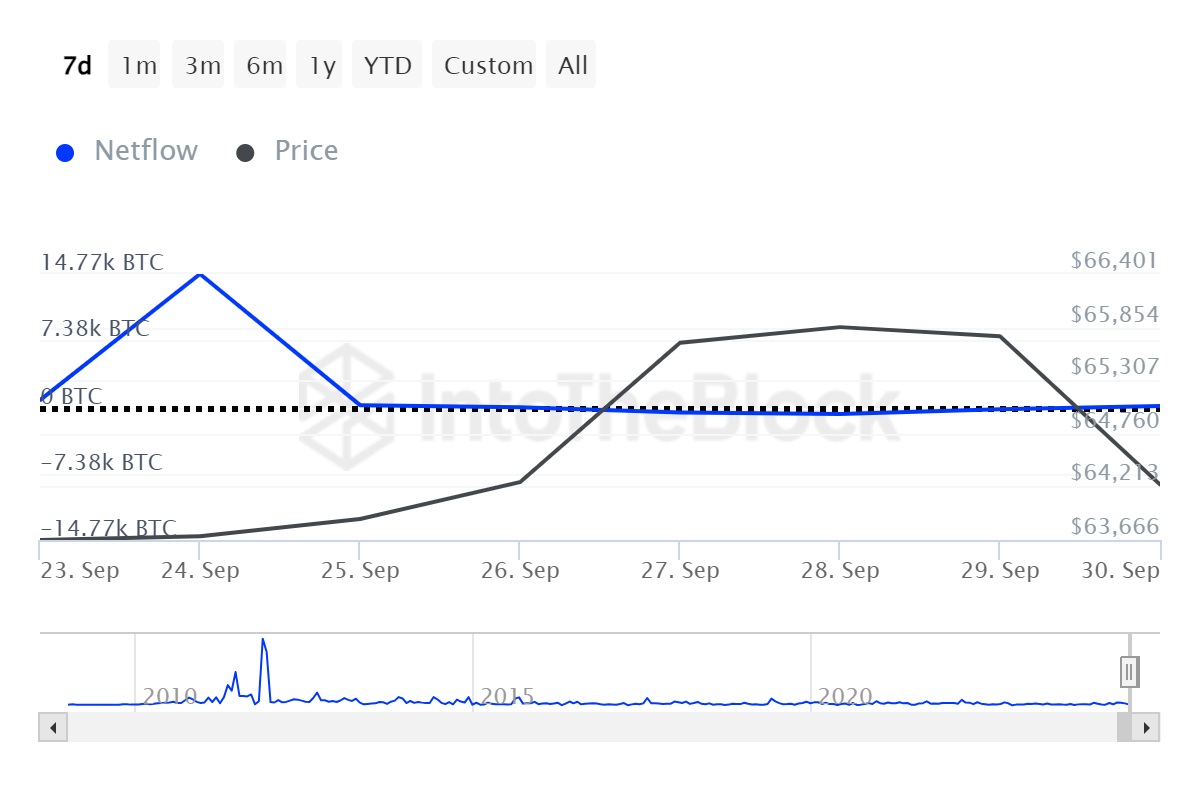

Source: IntoTheBlock

Finally, Bitcoin’s large holders’ netflow has hit negative levels since 25th September. This suggests that large holders are not opening new positions while they are closing the existing positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Reducing funds flow from large holders signals negative market sentiment as high outflow signals profit-taking or avoiding further losses.

Simply put, Bitcoin is experiencing a negative market sentiment with bears attempting to take over the market. As such, if these conditions hold, BTC will decline to $59,899. However, a reversal would see Bitcoin reclaim $62675 levels.