Fenbushi Capital, a highly active Tier-2 fund, divested some of its positions at a loss. The recent token transfers to Binance affected previously hot positions, which in some cases are down up to 90%.

Fenbushi Capital, the Chinese investment fund with a global foothold, divested some of its positions with transfers to Binance. The fund, which has joined a total of 144 deals in the crypto space, continues to support new startups. For older tokens, however, Fenbushi has shown readiness to take a loss.

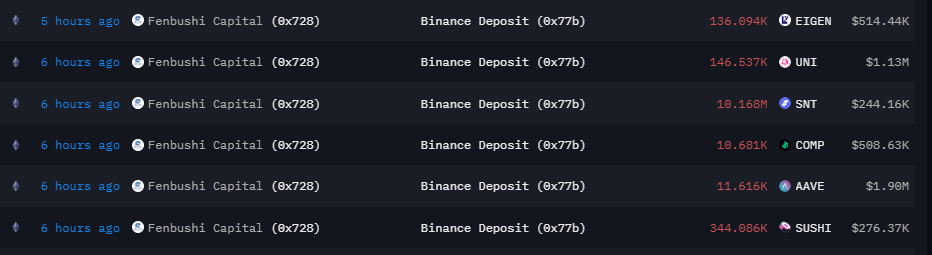

The deepest loss for Fenbushi was for SushiSwap, down around $2.4M or 90% of the investment. The fund also sold Compound (COMP) at an 82% loss. The fund also shed Aave (AAVE) just as the asset corrected from the $160 range down to $146. AAVE was seen as one of the most promising DeFi tokens in 2024, which outperformed other assets. The fund divested all AAVE, leaving only a dust amount of COMP, UNI, and other altcoins and tokens.

After the recent selling, Fenbushi Capital still holds a varied portfolio of altcoins and tokens. The known wallets hold $3.8M in crypto and stablecoins, including more than 22K ETH.

Fenbushi Capital divests EIGEN tokens

Fenbushi Capital also followed the lead of other whales and immediately sent its EIGEN token allocation for trading. The fund sold 136,094 EIGEN tokens, valued at above $500K.

The fund had a relatively low valuation, at least in comparison to another whale, known as @GiganticRebirth. The recipient of EIGEN consolidated seven airdrop wallets holding 253,946 EIGEN, valued above $1M.

The sale is still smaller than the allocation of TRON’s founder, Justin Sun. Through staking and early support for EigenLayer, Sun received an airdrop of 5.24M EIGEN valued at $22.9M, which was also moved to an exchange. The funds moved through an address that has a high probability of belonging to Sun.

Despite selling, soon after the initial crash, EIGEN recovered to trade at $4.12. However, the shift to selling from high-profile influencers may set a bearish tone. The selling arrives at a time when Bitcoin (BTC) shifted its direction, falling under $62,000.

Fenbushi Capital continues with new rounds

Fenbushi Capital is a fund that drove the growth of the Web3 boom in 2021, with investments in top projects like Maker DAO. The main focus of the fund was the Ethereum and BNB Smart Chain ecosystems.

The most recent rounds included Huma Finance, which raised $38M from a group of Tier 1 and Tier 2 funds. Fenbushi also participated in a $50M strategic round for Morpho, and previously raised funds for Pudgy Penguins in a mid-range $11M round. The fund has completed 10 rounds in partnership with Coinbase Ventures and has worked with Tier 1 funds Blockchain Capital, DragonFly Capital, OKX Ventures, and Animoca Brands.

Most of the completed rounds are for US-based startups, though Fenbushi is registered in China and also focuses on the Asia Pacific region. After the current market downturn, the overall returns of Fenbushi are in the negative, with an average loss of 6.39%.

Fenbushi has invested in high-profile, successful projects like Balancer, and the recently trending Moonbeam. Other earlier rounds have caused deeper losses. The fund backed projects that did not break out during the current bull market, such as VeChain and ZCash. Others, like Enjin Coin (ENJ), even received a risk warning from Binance, due to supply inflation.

Among the top gainers in the Fenbushi portfolio, WOO grew by 26.78% in the past month. The biggest loser was MUX Protocol (MCB), down by 31.77%, and WELL, losing more than 37%.

A large part of the tokens supported by Fenbushi were considered VC-backed coins with a limited float. The market managed to absorb most of the big unlocks, as some of the VCs sold their initial share. Despite this, VC backing continues, though at a slower pace.

In the past month, funds helped raise a total of $668M, of which $100M went to the largest round for Celestia (TIA). Despite the skepticism for VC-backed tokens, the market may be ready to absorb more projects with proven utility, in search for the next crypto unicorn. The past month saw a total of 107 funding rounds, though for smaller total sums compared to August.

Cryptopolitan reporting by Hristina Vasileva