- Long-term holders transitioning due to spot ETFs may indicate Bitcoin’s maturation and reduced volatility.

- Whale transactions are increasing, but new addresses remain stable, suggesting cautious market sentiment.

Bitcoin [BTC] price has remained relatively stable following a brief spike above $64,000 last week after the U.S. Federal Reserve announced a rate cut. The asset has settled within the $63,000 region, fluctuating within a tight range over the past few days.

As of this writing, Bitcoin was trading at approximately $63,728, down by 0.1% in the last 24 hours, showing consolidation rather than sharp price movements.

Bitcoin’s maturation and price stability

A recent analysis from CryptoQuant suggests that the maturing behavior of Bitcoin holders is playing a significant role in shaping the asset’s market trends.

Analyst Kripto Mevsimi indicates that since the introduction of Bitcoin Spot Exchange-Traded Funds (ETFs), long-term holders are gradually shifting their positions to new owners by taking profits.

This transition, according to the report, might be partly due to former Grayscale investors moving to Spot ETFs to benefit from lower fees. These new holders, having surpassed the critical 155-day on-chain holding threshold, are now categorized as long-term investors.

The shift from short-term to long-term holding has historically resulted in sharp price swings for Bitcoin. However, the growing influence of Spot ETFs and their integration into traditional financial instruments seem to have a stabilizing effect on the cryptocurrency’s volatility.

As highlighted in Mevsimi’s analysis, the gradual increase in long-term supply and the corresponding decrease in short-term supply reflect a changing market structure. The more stable prices suggest that Bitcoin is becoming a more mature asset, showing reduced volatility compared to its earlier years.

The expectation is that with greater stability and reduced price swings, Bitcoin could attract increased institutional demand. The current maturation process suggests a potential scenario where Bitcoin becomes more integrated into the global economy, appealing to a broader range of investors seeking more stable and predictable assets.

Bitcoin fundamental outlook

Despite this trend towards maturity, examining Bitcoin’s fundamental metrics is crucial in understanding its current and future potential. One such key metric is the number of new addresses.

Data from Glassnode reveals that the number of new Bitcoin addresses has remained relatively constant in the past month, ranging between 250,000 and 390,000.

While stability in new address creation often indicates a steady base of users, the lack of significant growth may signal that investor enthusiasm has yet to trigger a wave of new market participants.

This could mean that despite anticipation of a potential bull run in the upcoming quarter, Bitcoin is experiencing more cautious engagement from prospective investors.

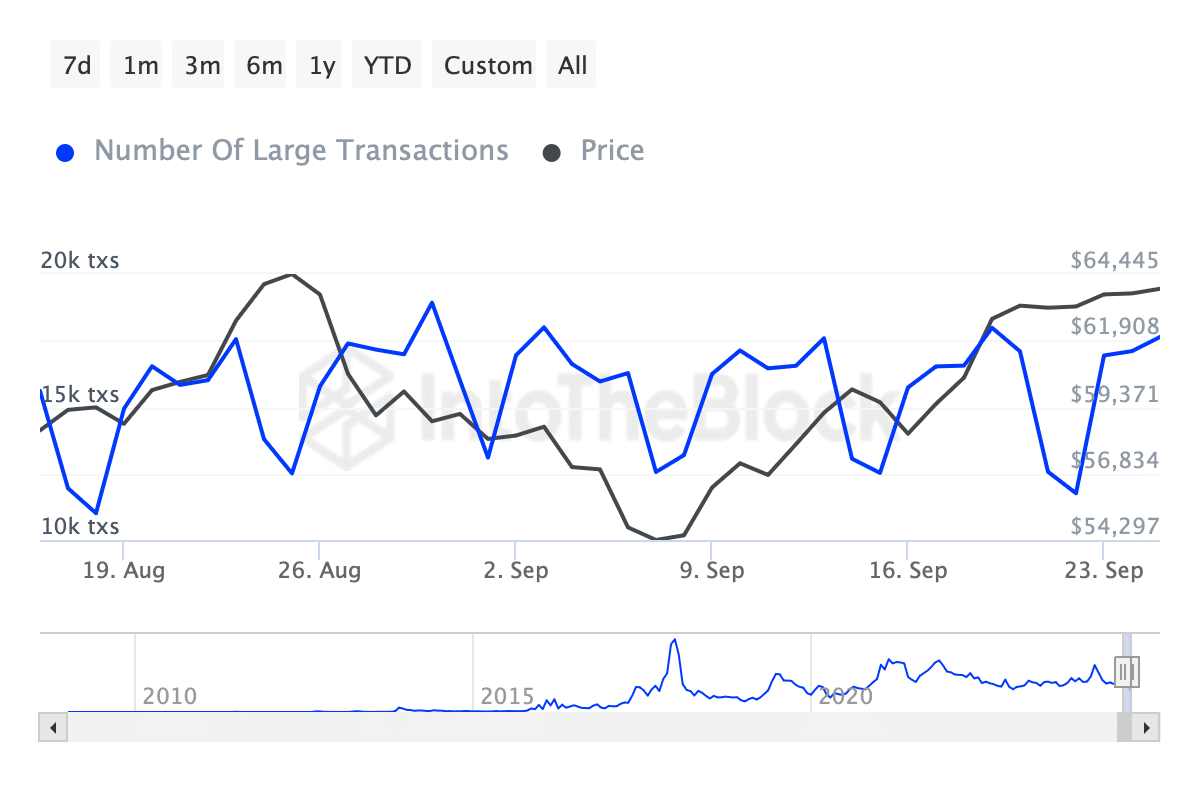

While new address growth has plateaued, another metric — whale transactions (those greater than $100,000) — has shown a notable uptick.

According to data from IntoTheBlock, whale transactions have increased from lows of around 11,000 to over 17,000 in the past month. This uptick could suggest heightened activity among institutional investors or high-net-worth individuals, potentially influencing market dynamics in favor of bullish momentum.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Increased whale transactions often indicate growing interest from those who are more likely to have significant influence on market movements.

It remains to be seen whether this trend will contribute to further price appreciation or whether it represents profit-taking by long-term holders.